Despite Reprieve, New Tariffs Will Hit Wide Range of Consumer Goods.

Levies of 10% on some apparel, electronics, watches and sporting goods from China start Sept. 1, followed by smartphones, laptops and toys Dec. 15

WASHINGTON—President Trump may have scaled back tariffs on Chinese goods this week to spare holiday shoppers, but consumers are still likely to feel a pinch.

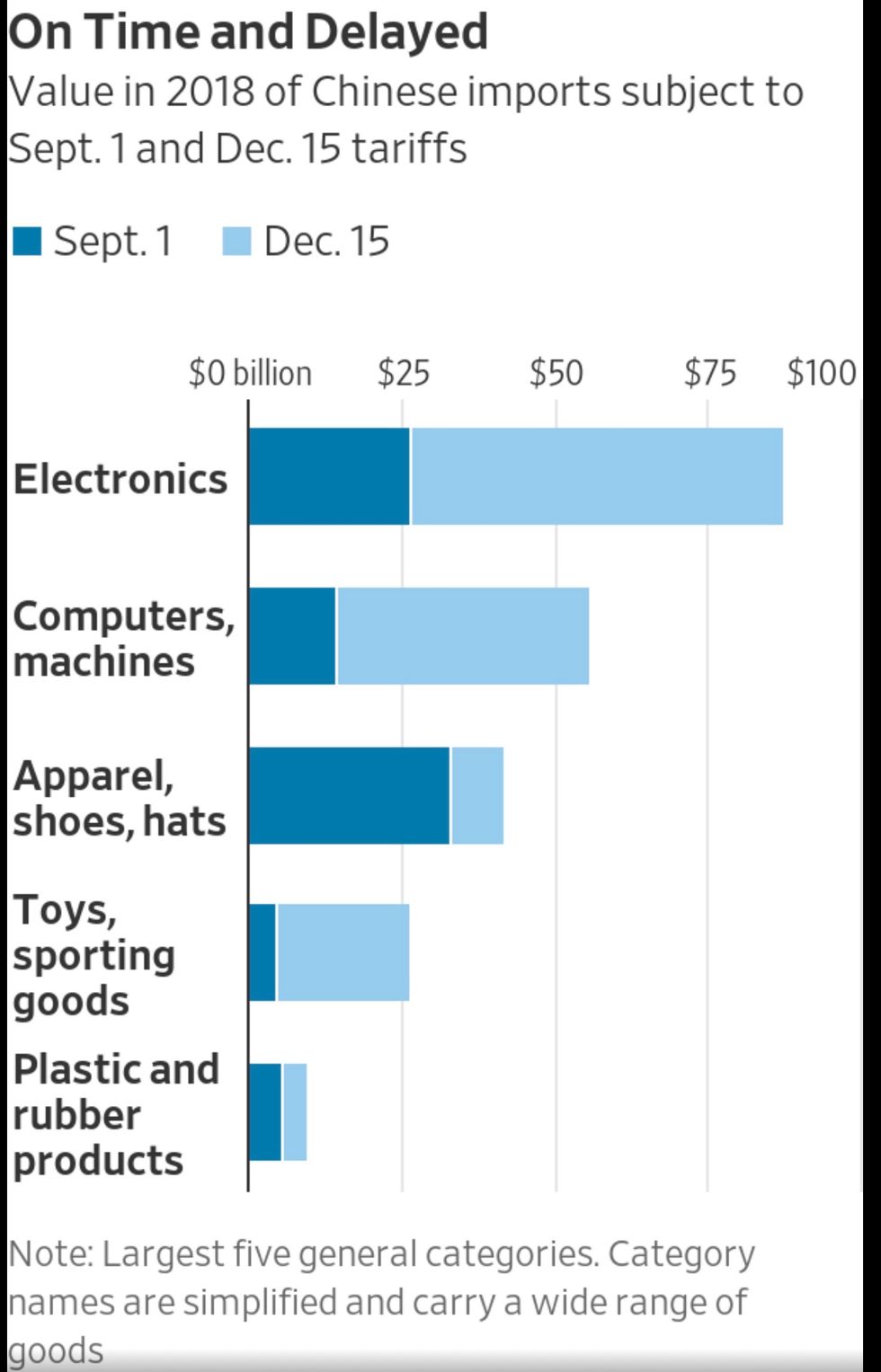

An array of apparel, electronics, watches and sporting goods from China will be hit with levies of 10% starting Sept. 1. The value of those and other products subject to the new tariffs totaled $111 billion last year, according to a Wall Street Journal analysis. While economists say the impact won't derail the U.S. economy, it could slow fourth-quarter growth.

"It is not entirely accurate to label this a de-escalation," said Chris Krueger, managing director of the Cowen Washington Research Group. He likened the policy to telling someone: "I was going to break both of your arms on Sept. 1—now I am only going to break your elbow."

Beijing wasn't impressed by the ratcheting back of tariffs, either. On Thursday, an official with the State Council's Customs Tariff Commission denounced the rise in tariffs and said "China would have no choice but to take necessary countermeasures."

Mr. Trump did sideline tariffs on smartphones, laptops, toys and other Chinese imports valued last year at $156 billion, saying Tuesday that he wanted to soften the impact on consumers for the holiday season. But those tariffs are set to kick in Dec. 15, and meanwhile the U.S. will in two weeks be collecting tariffs on about $361 billion in Chinese imports—the levies on the $111 billion worth of annual imports that starts Sept. 1, plus previous tariffs on $250 billion in Chinese goods.

Previous rounds of tariffs have largely spared consumers, with the administration targeting items such as telecommunications equipment, metal alloys and mechanical devices that tend to be purchased by businesses.

That changes next month. About $33 billion in apparel, shoes and hats are among the items subject to a 10% tariff on Chinese imports beginning Sept. 1, according to a Journal analysis of data from the U.S. Trade Representative's office and the Census Bureau.

The Sept. 1 list also includes about $27 billion in electronics. That includes a bevy of routine items ranging from wireless surveillance cameras to solid-state drives and some televisions, the Journal's analysis found.

All told, 69% of consumer goods from China will be subject to tariffs starting Sept. 1—up from 29% currently, according to Chad Bown, a senior fellow at the Peterson Institute for International Economics.

Mr. Trump held off on imposing all the threatened tariffs following warnings from retailers who said the levies could dim prospects for the holiday shopping season, the Journal has reported. The retreat also came as financial markets shuddered over fears that the U.S.-China trade war could put the global economy in a funk.

In determining which tariffs to postpone, one factor appears to have been the availability of alternatives to Chinese imports, according to the Journal analysis. A review of the tariff list indicates that tariffs were generally postponed for import categories, such as videogame consoles, where China accounted for about 75% or more of imports in 2018.

By Dec. 15, however, just about everything coming from China will be subject to tariffs. Only $19.8 billion of Chinese goods aren't covered, including pharmaceuticals, some medical equipment and organic chemicals, and items under special import provisions.

The office of the U.S. Trade Representative has said there will be a process for companies to seek exclusions from tariffs, however, if their business would be unduly damaged by the new duties.

But that is not the same as saying the effects will be unnoticeable to the U.S. economy. The direct effects of the newest tariffs would slow growth in the fourth quarter by about 0.1 percentage point, according to Gregory Daco, chief U.S. economist for Oxford Economics, a forecasting and economic analysis firm. He expects the economy to grow about 2% in the fourth quarter.

That damage is likely to persist into 2020, he said, and could be amplified by growing awareness of the tariffs, and growing uncertainty from businesses and financial markets about what to expect from future trade policy.

"The uncertainty that pertains to these tariffs is going to have an effect beyond the tariffs," said Mr. Daco. "It's not just about goods costing more, it's about the cost and time it takes for businesses to plan around these tariffs and trade tensions."

Overall inflation has been modest in the past year, with the Labor Depart-ment's consumer-price index up about 1.8% in the 12 months through July. But many items in the consumer-price index, from rent to health care to higher education costs, don't have prices that are significantly influenced by tariffs.

The Trump administration focused its early tariffs on intermediate or capital goods, such as machinery purchased by businesses. Price increases on those items, though a hit to the U.S. importers paying the tariffs, aren't obvious at the consumer level.

But when tariffs have hit con-sumer goods, the price increases for retail customers have been more apparent. According to a Goldman Sachs analysis of Labor Department data earlier this month, prices have risen by 3% among the categories of items that have faced tariffs, such as laundry equipment and furniture.

Prices have declined by about 1% for core goods that haven't faced any new tariffs.

That backs up the findings of most research examining the tariffs, such as two high-profile studies earlier this year—one from a quartet of econo-mists, including the chief economist of the World Bank, working on a National Science Foundation grant, and another from the Centre for Economic Policy Research written by economists from the Federal Reserve Bank of New York, Princeton and Columbia universities.

Both concluded that although tariffs are formally assessed on U.S. importers when they bring in goods from foreign countries, the costs are passed on almost entirely to consumers.

August 17, 2019

###

August 17, 2019

Voices4America Post Script. If you are wondering how #TrumpTariffs have and will affect you as a consumer, especially starting September 1, read what the WSJ said. This was their top story today. Share this to spread the word. #TrumpSlump