Below are the 4 big numbers from the Congressional Budget Office's analysis of the Senate Republican plan to repeal and replace the Affordable Care Act.

The bill would reduce the federal

deficit by $321 billion over 10 years.

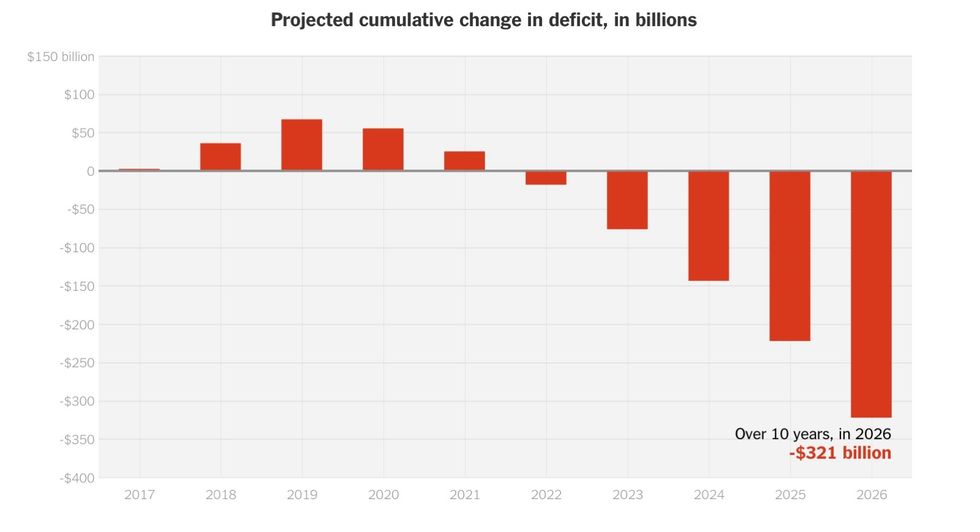

The federal government would save billions, mostly by making deep cuts to Medicaid. Much of the savings would come near the end of the next decade.

Projected cumulative change in deficit, in billions

The savings could have been even larger, but the bill would repeal most of the tax increases that the Affordable Care Act imposed primarily on the wealthy to help pay for expanded coverage.

22 million more Americans

would be uninsured by 2026.

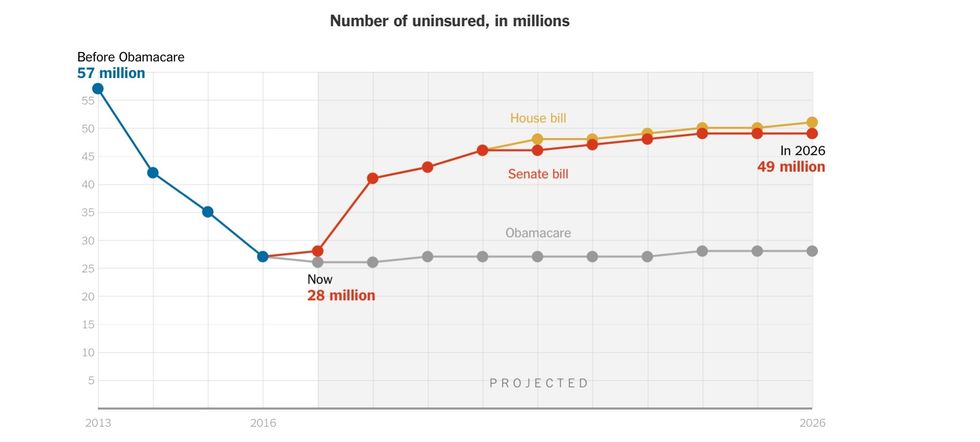

The budget office projects that by 2026, 49 million people would be uninsured, compared with 28 million people if the current law remained in effect. (The total increase is 22 million due to rounding.)

Number of uninsured, in millions

The increase in the number of uninsured would be disproportionately larger among older people with lower incomes.

Several major changes under the Senate plan would cause fewer people to have insurance.

The bill repeals the individual mandate, which requires all Americans to obtain health insurance if they can afford it or else face penalties. The mandate, which many Republicans criticize, was created to keep insurance affordable for those who are older or sick.

Without the mandate, many healthy people are expected to drop coverage, driving up prices for those who need it most and ultimately causing even more people to drop out of the individual market.

The bill would also substantially reduce spending on Medicaid and reduce the value of tax credits that individuals use to buy health insurance, pricing many out of the market.

15 million fewer people would

be enrolled in Medicaid by 2026.

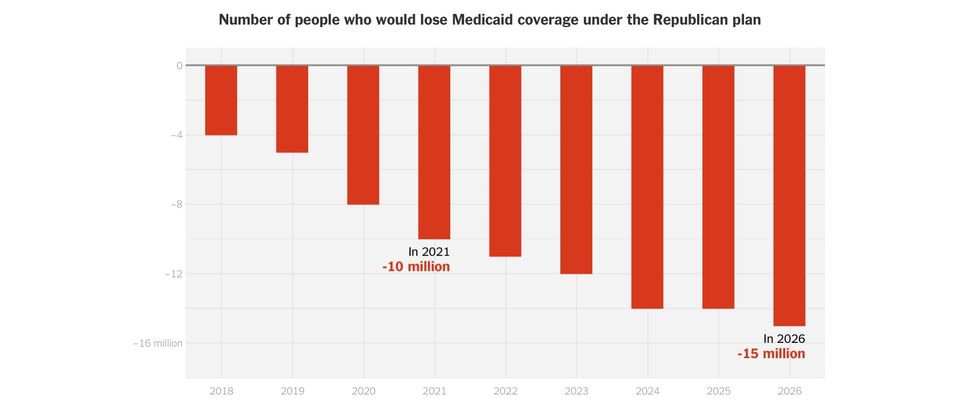

The largest group to lose health insurance coverage would be people with Medicaid. In 10 years, the C.B.O. projects, there would be 15 million fewer Medicaid enrollees.

Number of people who would lose Medicaid coverage under the Republican plan

Currently, the federal government pays at least 90 percent of the costs for newly eligible beneficiaries in the 31 states that expanded the program under the Affordable Care Act.

Under the Senate plan, federal payments would be reduced for those enrollees beginning in 2021, and in 2024, federal support would be sharply curtailed, most likely causing many states to end the expansion.

Separate from the expansion, future federal spending would be capped per enrollee, based on how much each state has spent historically.

By putting Medicaid on a budget, the bill saves $772 billion over 10 years.

Average premiums would

decrease by 20 percent in 2026.

Republican lawmakers cite rising premiums as a main reason for repealing the Affordable Care Act.

The C.B.O. estimates that average gross premiums would initially rise under the Senate bill, then drop by about 20 percent, compared with what it would be under the current law, in 2026.

This would largely be achieved by offering skimpier plans with higher deductibles, and by pricing the old and the sick out of the insurance market.

The Senate bill would make financial assistance for premiums less generous than under the current law. That means that average deductibles for the plans would be much higher. For many low- and middle-income Americans who currently receive subsidies, their share of premiums would rise.

Insurance premiums for a single

individual with annual income of $26,500

Age | Under Obamacare | After tax credit | Under Senate bill | After tax credit |

|---|---|---|---|---|

21 years old | $4,300 | $900 | $3,200 | $1,300 |

40 years old | $5,500 | $700 | $5,000 | $1,600 |

64 years old | $12,900 | 0 | $16,000 | $2,000 |

Note: Numbers are for a bronze plan.

The new subsidy structure would require older people to pay a larger share of their incomes for coverage, reducing the amount they get to help pay for premiums.

Changes in rules about insurance prices would also cause big premium increases for older Americans who don't qualify for subsidies.

Even though average premiums would decrease, the amount that many Americans spend on health care over all would increase as deductibles rise and plans cover fewer benefits in many states.

Source: Congressional Budget Office

By HAEYOUN PARK and WILSON ANDREWS in the New York Times, JUNE 26, 2017.Additional reporting by Margot Sanger-Katz.

###

June 27, 2017